Whether designing new buildings or renovating existing ones, building owners focused on reducing cost frequently push architects and engineers to place energy efficiency and renewable energy on the chopping block in favor of other desirable features. From private developers to property management companies and institutional portfolio operators, building projects facing a fixed budget often have trouble justifying sustainability accouterments that may take many years to pay off solely with utility savings.

Motivating Energy Efficiency

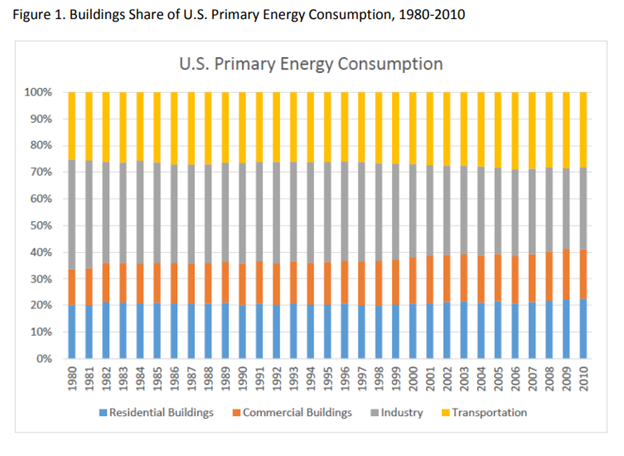

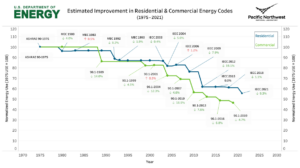

These decisions have far-reaching impacts on national energy security and environmental impacts, as buildings have historically accounted for between 30%-40% of total US annual energy consumption and related carbon emissions. While the US population grew by 37% from 158 to 216 million during the post-war boom between 1950 and 1975, US total annual energy consumption grew more than 100% from 35 quads to over 70 quads over the same period – three times faster than the population! Facing the price spikes and supply scares of the 1970s energy crisis, US regulators first attempted to regulate building energy efficiency with the first building energy codes mandating minimum requirements for building insulation, lighting power, and HVAC system efficiency.

Between the date of the first building energy code implementation in 1975 through 2018, the US population grew 51%, while the US total annual energy usage grew by only 42% to 100 quads and began to level off. This dramatic improvement in energy efficiency is a clear effect of increasingly stringent regulations over time, with new buildings built to the current energy code using about half of the code-built buildings in 1975.

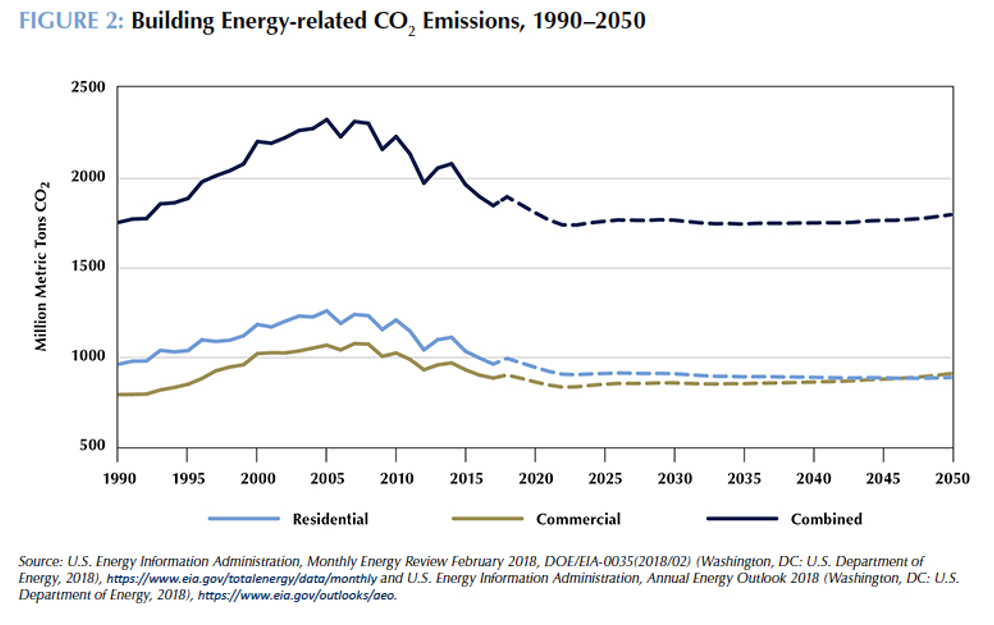

However, an estimated two thirds of the global building stock in 2040 will be buildings that exist today, unaffected by improved energy codes unless renovated. Worse, budget-minded building owners and operators beholden to lenders or taxpayers with visions of payback periods far shorter than the lifespan of buildings may defer maintenance and seek creative means to circumvent energy efficiency regulations viewed as an obstacle to profitable operations. The US Energy Information Administration’s historical records and future projections of building-sector carbon emissions demonstrate this ”existing building ceiling” on the regulatory influence of building energy use.

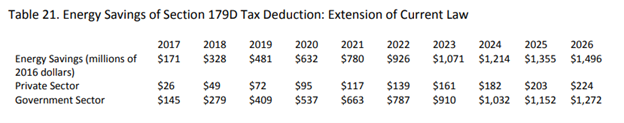

Faced again with rising energy prices in the early 2000s, the federal government implemented the Energy Policy Act of 2005, which established the Tax Code Sections 179D (commercial building energy efficiency tax deduction) and 48 (renewable energy investment tax credit, commonly known as the ITC). These provided tax incentives upfront for money spent on designing and building energy-efficient buildings incorporating renewable energy systems, encouraging both sustainable retrofit and new construction building projects. This tax deduction ultimately saves local, state, and federal governments more than the incentives costs – nearly $6 billion over 10 years according to a statistical analysis done by the consulting group Regional Economic Modeling Inc. (REMI) in 2017.

The Energy Efficiency Tax Deduction

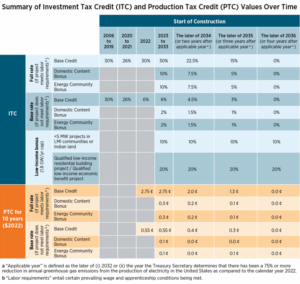

Both the Section 179D energy efficiency tax deduction and Section 48 ITC have enjoyed broad popularity and have been repeatedly extended, with the 179D deduction recently made permanent by the Consolidated Appropriations Act of 2021, and both the 179D deduction ITC increased in value by the Inflation Reduction Act of 2022.

The Section 179D tax deduction specifically incentivizes project teams to make energy efficiency improvements to their building’s HVAC, lighting, or enclosure systems. To receive the deduction, the building must demonstrate at least 25% improvement with respect to modern energy codes (defined as the most recent version of ASHRAE Standard 90.1 at the time the improved systems were placed into service). Project teams can claim additional deductions by demonstrating up to 50% improvement over code-minimum energy efficiency levels. For tax year 2023, the incentive starts at $2.50/SF and maxes out at $5.00/SF for projects meeting prevailing wages as determined by the US Department of Labor and a 12.5% minimum apprenticeship labor hour requirement (goes up to 15% in tax year 2024). Projects not meeting the labor requirements are only eligible for a $0.50/SF starting incentive, maxing out at $1.00/SF. Taxpayers can seek the deduction for improvements made in the past, though are limited to claiming the deduction per the rules in force when the new systems were placed into service, with a maximum between $1.80/SF-$1.88/SF for buildings placed into service in 2021 and earlier.

The Section 179D Tax Deduction can be claimed not only by building owners, but by building tenants, and project architects and/or engineers working on governmental projects to help reduce the incremental cost of designing a more energy-efficient building. To claim the tax deduction, taxpayers must submit ITS Form 7205 with an energy modeling and field verification report developed per the requirements of NREL’s Energy Savings Modeling and Inspection Guidelines for Commercial Building Federal Tax Deductions for Buildings in 2016 and Later. These guidelines require that all energy analysis be conducted by an ASHRAE-accredited Building Energy Modeling Professional (BEMP), and inspection activities be conducted by an architect, engineer, or contractor licensed to practice in the building’s jurisdiction.

The Clean Energy Tax Credit

The Section 48 investment tax credit incentivizes project teams to invest in on-site clean energy systems including solar photovoltaics, solar water heaters, wind turbines, geo-exchange systems, fuel cells, and battery storage technologies. The credit also incentivizes infrastructure or equipment for supporting or facilitating the clean energy system that wouldn’t have been otherwise purchased, for example, roof structural enhancements to support the weight of a new roof-mounted PV system. The ITC provides projects meeting minimum labor requirements with the full rate: 30% of the renewable energy system first costs, with an additional 20% bonus incentives available for projects meeting domestic content and defined energy community requirements. Like the current 179D tax deduction, the current ITC provides reduced benefits for projects not meeting minimum labor requirements, with a base credit of only 6% with a limited 4% bonus incentive. Section 48 also allows taxpayers to claim a Production Tax Credit (PTC) incentive based on renewable energy production instead of first costs, paying up to $0.0281/kWh produced for 10 years as an alternative to the cost-based ITC. Section 48 further allows project teams to depreciate their new renewable energy property in just 5 years, compared to the standard 39-year depreciation period allowed by the IRS for real property, providing an accelerated tax deduction opportunity in addition to the initial tax credit, significantly reducing the time taken to pay back the investment.

As part of the ITC changes brought about by the 2022 Inflation Reduction Act, the Section 48 tax credit (though not the special depreciation) can now be claimed by qualifying local government entities, non-profit organizations, and other nontaxable entities via direct pay. To claim the tax credit, taxpayers must submit IRS Form 3468, while nontaxable entities must register with the IRS direct pay portal and submit IRS Form 990-T.

The Section 179D tax deduction and Section 48 tax credit help both the private and public sectors realize the benefits of energy efficient and clean energy investments upfront, rather than gradually over the new system’s lifetime, incentivizing sustainable investment, improving national energy security, and helping achieve climate goals! Project teams working on new construction and renovation projects should be aware of the money on the table to help their projects reduce energy consumption. Make sure you account for these incentives before writing off renewable and energy-efficient technologies that are too expensive for your project!